Mutf_In: Icic_Pru_Infr_1u3y03t

The ICICI Prudential Infrastructure Fund (Mutf_In: Icic_Pru_Infr_1u3y03t) targets investments in key infrastructure sectors, including transportation, energy, and telecommunications. Its strategic approach aims to harness emerging market opportunities for long-term capital growth. Historical performance indicates a consistent ability to outperform benchmark indices, suggesting resilience amid market volatility. This fund presents an intriguing option for investors seeking stability and growth, but what factors contribute to its sustained success in the infrastructure landscape?

Overview of ICICI Prudential Infrastructure Fund

The ICICI Prudential Infrastructure Fund, as a dedicated mutual fund, focuses on investments in infrastructure-related sectors, which are pivotal for economic growth.

Its fund objectives are to capitalize on emerging market trends that drive infrastructure development.

Key Features and Investment Strategy

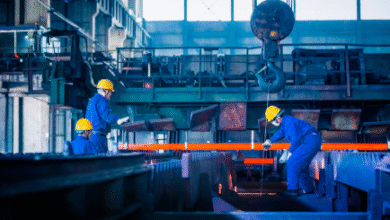

Key features of the ICICI Prudential Infrastructure Fund include a focus on sectors such as transportation, energy, and telecommunications, which are integral to national development.

The fund’s investment objectives prioritize long-term capital appreciation while navigating various risk factors associated with infrastructure investments.

This strategic allocation aims to harness growth potential in essential industries, appealing to investors seeking both stability and opportunity in their portfolios.

Performance Analysis and Historical Returns

While examining the ICICI Prudential Infrastructure Fund’s performance, one can observe a consistent track record of returns that aligns with its long-term investment objectives.

Historical performance highlights a favorable return comparison against benchmark indices, indicating resilience during market fluctuations.

This performance underscores the fund’s strategic positioning within the infrastructure sector, appealing to investors seeking a balanced approach to capital growth and risk management.

Benefits of Investing in Infrastructure Mutual Funds

Investing in infrastructure mutual funds offers significant advantages that align with both growth potential and risk diversification.

These funds provide diversification benefits by spreading investments across various infrastructure projects, mitigating individual investment risks.

Moreover, a thorough risk assessment can reveal opportunities in sectors poised for growth, appealing to investors seeking long-term stability and capital appreciation while maintaining a balanced portfolio.

Conclusion

In conclusion, the ICICI Prudential Infrastructure Fund exemplifies a sturdy bridge in the investment landscape, connecting investors to growth opportunities in vital sectors. Just as a well-constructed bridge withstands the test of time and weather, this fund has shown resilience during market fluctuations, consistently outperforming benchmark indices. With a strategic focus on infrastructure, it offers a reliable path for capital appreciation, making it an appealing choice for those seeking stability and diversification in their portfolios.