Mutf_In: Hdfc_Manu_Reg_1qfmfs3

Mutf_In: Hdfc_Manu_Reg_1qfmfs3 represents a carefully structured investment vehicle under the HDFC brand. It prioritizes a balanced approach to risk and return through diversified strategies. While its historical performance suggests consistency, potential investors must consider market fluctuations and the necessity of a long-term investment mindset. Understanding the intricacies of this fund could reveal critical insights for those contemplating their financial future. What factors truly define its appeal in the current market landscape?

Overview of Mutf_In: Hdfc_Manu_Reg_1qfmfs3

The Mutf_In: Hdfc_Manu_Reg_1qfmfs3 represents a specific mutual fund offering under the HDFC umbrella, characterized by its strategic investment approach and regulatory compliance.

This fund employs diversified investment strategies, aligning with prevailing market trends to optimize returns while managing risk.

Investors seeking to understand its framework will find a meticulous alignment between the fund’s objectives and the dynamic nature of financial markets.

Key Features of the Fund

Key features of Mutf_In: Hdfc_Manu_Reg_1qfmfs3 highlight its competitive edge in the mutual fund landscape.

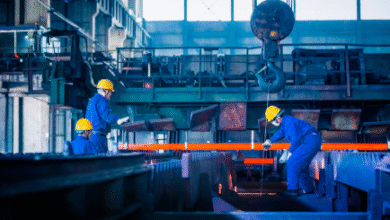

The fund’s performance is bolstered by a well-defined investment strategy that emphasizes diversified assets, risk management, and market analysis.

This strategic approach enables investors to capitalize on market opportunities while maintaining flexibility, ensuring that their investments align with personal financial goals and preferences.

Benefits of Investing in HDFC Mutual Fund

Investors can realize significant advantages by choosing to invest in HDFC Mutual Fund, which is known for its robust performance and strategic management.

The fund offers a diversified portfolio, effectively balancing risk and return.

Furthermore, its focus on long-term growth aligns with investors’ aspirations for financial independence, making it an attractive option for those seeking consistent returns and capital appreciation over time.

Potential Risks to Consider

While the potential for returns in HDFC Mutual Fund is appealing, it is crucial to acknowledge the inherent risks associated with such investments.

Market volatility can significantly impact fund performance, making it essential for investors to assess their investment horizon carefully.

Short-term fluctuations may erode gains, necessitating a long-term perspective to weather the uncertainties inherent in the financial markets.

Conclusion

In conclusion, the HDFC Manu Reg 1qfmfs3 mutual fund presents a compelling option for investors seeking a balanced approach to growth and risk management. Its strategic diversification and alignment with market trends position it favorably in the competitive landscape of mutual funds. However, potential investors must remain vigilant about inherent market volatility and adopt a long-term perspective to fully realize the fund’s benefits. Thus, careful consideration of both opportunities and risks is essential for informed investment decisions.